Introducing Carrot 🥕

Why we started building the product…

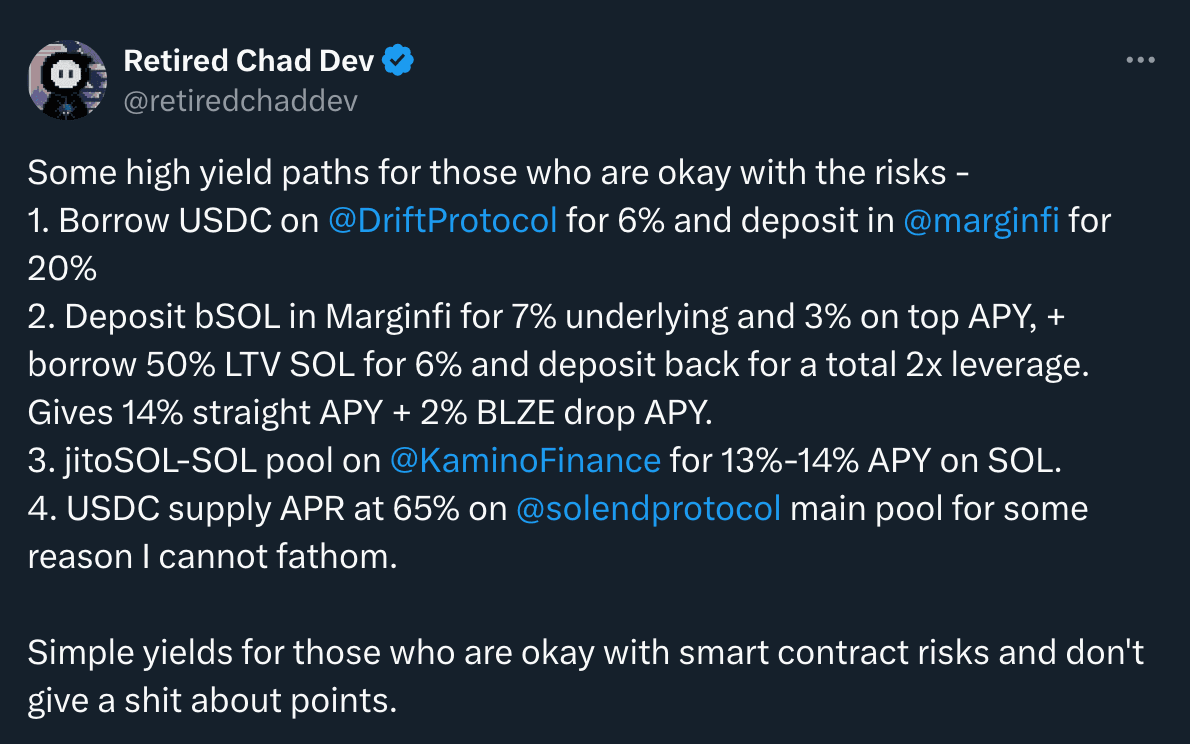

I hated seeing tweets about how easy DeFi was for everyone, but my own experiences always fell short because of a few key UX issues I couldn’t get over

- all these random platforms that had 50+ offerings made it difficult to understand solid opportunities vs those with too much risk

- once I lent my tokens, they left my wallet view and checking in on them required connecting my wallet either back to the platform (which now means multiple places)

I wanted an easy way to use automation to my advantage so I could guarantee I’d get the best rate over time Have it so my wallet would show me the performance of my assets anytime, anywhere

A few problems though…

I knew that to solve the visibility problem, we would need to have a single token, with liquidity behind it in order for wallets to automatically pick it up for display in my wallet. To figure out lending rates, so we could automatically transfer funds to capture it, would need an off-chain component, which would need to be able to then communicate instructions on-chain.

This sounded a lot like Liquid Staking Tokens. Pooled stake accounts that are distributed based on “criteria” to multiple validators, plus MEV rewards that are accrued back to a singular token value rather than increasing individual stake account units like traditional staking.

Could we…

Create a protocol that facilitated the accepting of tokens in return for a Liquid Yield Token, could be controlled by an off-chain strategy while protecting against a whole host of risks, and then not only let holders redeem for tokens back, but also more conveniently swap them on the open market…

Of course we can… we have the experience from building the Raindrops protocol, Boots trait marketplace + platform and pack creation/distribution/opening experiences to pull this off.

But to do so we would need to:

- Create an on-chain issuance and redemption program

- Create an oracle based NAV program

- Build CPI integrations with top platforms and more importantly structure the program for future integration growth

- Have a configurable fee capture mechanic to ensure a viable business could be built here

- Develop an off-chain watcher to perform the yield aggregator strategy

- Securely let the strategy interact with the on-chain program to execute transactions

- Figure out how to run arbitrage between a Liquidity Pool and our redemption mech to ensure price says inline with computed NAV

Whew. That is a lot… but if we pull this off, the opportunity is massive…

You see, the mechanics we just described form the foundation of the next gen investment fund. The ability to form capital around a brilliant strategy, giving protections to both depositors and strategists that taps into the entire DeFi ecosystem in a win-win-win capacity makes this a no brainer risk to take.

We believe that consumers will prefer these sort of strategy tokens over the alternative process of discovering opportunities. Furthermore, the platforms out there creating these opportunities are well served by our ability to direct capital their way without spending CAC for each individual user. As the fund grows, the ability to move with size increases our area for successful outcomes - which then increases our ability to attract more capital… snowball ensues